I’m searching for the greatest dividend-paying stocks to buy and hold for the long term. Here are two from the FTSE 100 I’ll aim to buy when I have spare cash to invest.

Rio Tinto

Dividend yield: 6.6%

Raw materials demand is highly sensitive to broader economic conditions. So with the world economy facing near-term pressures the earnings outlook at Rio Tinto (LSE:RIO) is highly uncertain.

Yet from a long-term perspective the profits potential here is massive. It’s why I already own the mining giant and plan to hold it for at least the next decade.

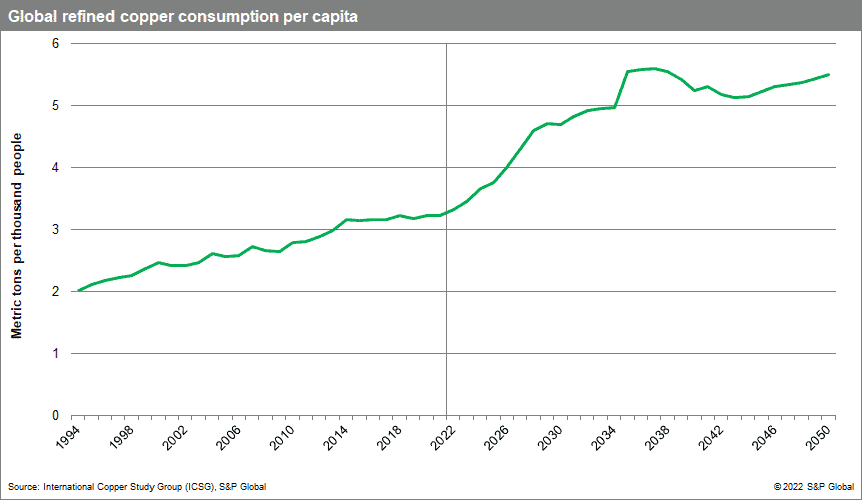

Population growth means that commodities consumption has steadily increased over decades. However, demand for metals looks set to explode over the next 10 to 20 years as new technologies emerge.

Take copper, for instance. Use of the red metal is expected to rocket as investment in renewable energy takes off and sales of electric vehicles and consumer electronics soar. This is shown in the graph below.

Rio Tinto is one of the world’s top 10 copper producers and so is well placed to exploit this opportunity. In fact it plans to triple production at its Oyu Tolgoi underground mine by 2030 to give profits a huge boost. This will make its Mongolian mine the fourth-largest copper mine on the planet.

The business is also a major producer of other commodities for which demand is tipped to balloon. These include iron ore, lithium, and aluminium. Rio Tinto should be able to command high prices for some of its key materials, too, given weak levels of new supply that are set to come online.

BAE Systems

Dividend yield: 3.1%

I expect defence business BAE Systems (LSE:BA.) to continue growing shareholder payouts strongly over the next decade. This in my view makes it an excellent stock to buy for passive income.

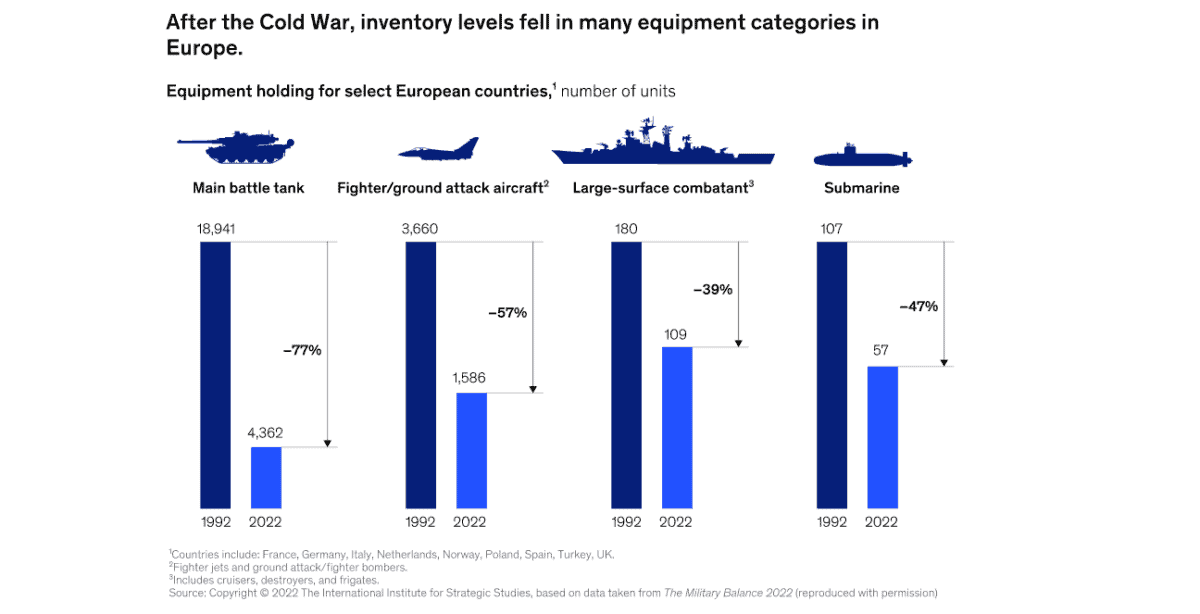

Western countries have started a new programme of rapid arms spending following Russia’s invasion of Ukraine. But fears over foreign policy in the Kremlin aren’t the only driver of weapons demand. Rising concerns over Chinese expansionism, along with persistent concerns over global terrorism, are also pushing defence budgets higher.

A steady fall in military inventories suggests that significant rebuilding is needed from current levels, too. The chart below shows how far levels of tanks, planes and boats have fallen across Europe, for instance.

Companies like BAE Systems stand to make huge profits in this landscape. In 2022, the company watched order intake rise more than £15bn year on year in response to the Ukraine war. This pushed total intake to all-time highs of £37bn.

BAE Systems also stands to take advantage of soaring arms budgets in fast-growing emerging markets. Singapore, for example — which is a key Asian hub for the FTSE 100 firm — plans to hike defence spending by $2.8bn in the four years to 2028, to $16.5bn.